When the dust settles on the breathless wash-up of retail sales over the holiday season in the US and Europe, we will be left with one major learning: the way people shop has changed. But when we look back at 2013 in years to come, we may well conclude that this year stands as the point in history when the entire process on consumer goods marketing changed forever.

When the dust settles on the breathless wash-up of retail sales over the holiday season in the US and Europe, we will be left with one major learning: the way people shop has changed. But when we look back at 2013 in years to come, we may well conclude that this year stands as the point in history when the entire process on consumer goods marketing changed forever.

How has consumer goods marketing changed in a year?

During the course of this year we have been presented with incontrovertible evidence that three major seismic changes have happened, globally.

- The web is a mainstream component of brand choice – It was just two years ago that Jim Lecinski at Google published his findings in “ZMOT – Winning the Zero Moment Of Truth” and already the term ZMOT has been coined by marketers globally. Jim’s e-book laid an entirely new mental model for marketing consumer goods. New research by Joanna Flint at Google in Asia demonstrates that ZMOT, the concept that consumers use internet-based information sources as a key (if not the key) source of information when making a brand choice is not just a US phenomenon, but a global one. Research presented in the forthcoming study “Winning at the Zero moment of Truth – Women, Consumer Packaged Goods and the Digital Marketplace” shows that women across a basket of emerging and developed Asian economies now use the internet as the primary or secondary source of information when they make decisions about consumer goods brands.

- Online shopping is no longer a niche behavior – Not everyone buys everything online, but the incidence of online purchase is rapidly growing. There’s absolutely no doubt that this year’s explosive growth in seasonal sales online in China and the US demonstrate a shift in the way we buy. Only the most closed-minded observer would suggest that this tide is likely to halt and recede. As shoppers learn to trust the online environment through their experience of it, more and more purchases will go online.

- The lines between physical retail and online retail are blurred – Last year’s end of year wash-ups were full of talk of the importance of ‘showrooming’ and ‘omnichannel’ retailing. Much of the hype around this is already passé. Shoppers have passed the point where they consider a retailer’s online offer to be separate from its offline one and for many the novelty of comparing product and price offers online whilst in-store is wearing off. It’s increasingly common to see global retail brands positioning themselves as being “in-store, online and mobile”. As a result shoppers increasing select retail brands over retail outlets – shoppers increasingly say “I shop at X” instead of, “I go shopping at my local Y”.

What does all this mean for consumer goods marketers?

In short, these changes have massive implications for consumer goods marketers, many of whom are yet to consider their effects on the way products are marketed and sold today.

- ‘Spray and pray’ will become increasingly unsustainable as a lead communication strategy – Mass consumer communication via TV and other traditional media has been the key mode of consumer communication since the early 60’s. Whilst this type of communication remains a key influencer of consumer choice, its role has changed. Increasingly it is a stimulus to drive further research and as media becomes more fragmented, its potency will inevitably dilute. Consumer goods marketers and their agencies will have to give greater thought to the role of mass communication in their marketing mix. It will have to become more targeted in its audience and its message and in some cases it will become secondary to more efficient communication strategies via digital media.

- The value of physical retail distribution is no longer assured – Holiday sales in the US actually appear to be down by nearly 3% so far this year, despite explosive sales online – why? Online sales are replacing retail sales. Consumer goods companies invest massively in sales and distribution via traditional retail. The continued growth of these channels is no longer universally assured. New online channels and indeed retailers are likely to grow rapidly in the coming years. This will put sales teams under extreme pressure, not just as they struggle to create new skills but also as they wrestle with the demands of bricks and mortar retailers in decline.

- The ability to target and lead specific groups of consumers toward a brand is now a point of competitive advantage – As mass communication wanes in efficacy, more targeted communication is becoming more important. In the past, those with the largest advertising budgets gained competitive advantage. Today this competitive advantage is being eclipsed by companies who have the greatest competence in effectively targeting specific groups of consumers and leading them to the point of active engagement with the brand. This is a new model which prizes brains over brawn.

- Converting brand considerers to buyers online is an imperative for all brands – For the first time in history, we have a tangible, measurable vehicle for brand consideration in real time. However, no true value is gained from a ‘like’ or a ‘share’. Whilst both are evidence of active consideration, neither deliver a concrete value until they convert to an incremental sale. Too much of today’s ‘digital marketing’ efforts concentrate on securing engagement. This is a hollow goal; attention must turn to rapidly converting good will into purchases. Best-in-class brands are now seeking ways to convert ‘likes’ to ‘buys’ online either via targeted retail channels or through wholly-owned or partner e-commerce sites.

Marketers grappling with the realization that they might need to change are struggling to answer the key questions of how they might approach the new reality – they need a new blueprint for consumer goods marketing.

In my next blog, I’ll lay out what I see the key components of this blueprint might be and discuss what to do next. To make sure you receive a copy in your inbox as soon as it’s published, subscribe to my blog here.

Mike Anthony

Mike Anthony

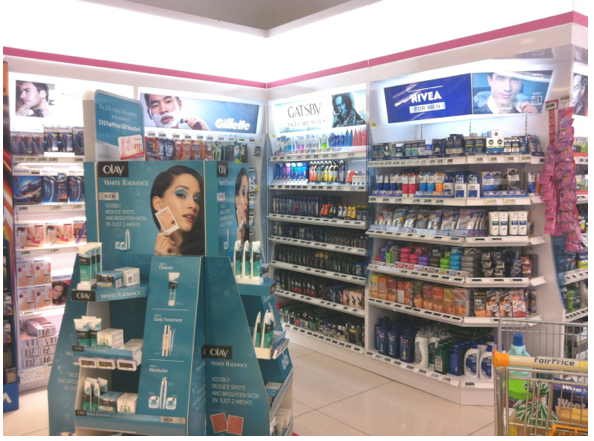

If we accept that moms might be a key group to target, we also have to accept that in order to reach them, we have focus on the retail channels they shop in. I’m guessing that most people buying shampoo for their kids do so when they are buying groceries for the whole house, so I was keen to see what Unilver was doing in Singapore’s leading chain of supermarkets, Fair Price. And here’s what I saw: the brand is neatly positioned with other anti-dandruff shampoos:

If we accept that moms might be a key group to target, we also have to accept that in order to reach them, we have focus on the retail channels they shop in. I’m guessing that most people buying shampoo for their kids do so when they are buying groceries for the whole house, so I was keen to see what Unilver was doing in Singapore’s leading chain of supermarkets, Fair Price. And here’s what I saw: the brand is neatly positioned with other anti-dandruff shampoos: