A very Happy New Year! As many of us dust of the keyboard and make resolutions regarding our waistlines, thoughts turn to the priorities we might set for the coming year. If you’ve paid attention to the extensive coverage given to online sales over the last month, you may be seriously considering whether this year is the year to make significant investments in online retail channels.

A very Happy New Year! As many of us dust of the keyboard and make resolutions regarding our waistlines, thoughts turn to the priorities we might set for the coming year. If you’ve paid attention to the extensive coverage given to online sales over the last month, you may be seriously considering whether this year is the year to make significant investments in online retail channels.

Your decision will of course be based on how important you believe online retail will become in your market and category and at what rate its importance will grow. 2013 saw online sales reach the highest levels ever in markets around the world. There’s no doubt that as shoppers become more time poor and continue to struggle with suppressed incomes, many will be attracted to e-tailers offering lower prices and savings in time and transport costs. Yet in many markets, shoppers lack confidence in online retail offers: concerns abound about reliability and quality of products. Equally shoppers in many markets are still unable to access credible e-tail offers either locally or via well-established global players who refuse to deliver outside limited geographies.

How fast will online retail channels grow in 2014?

Depending on where you play and what categories you operate in, there are two potential pathways for the growth of online sales.

The first is that sales will grow exponentially: (and 120% annually between 2003 and 2011). Whilst online retail sales are , in some categories online represents a significant share of business. Some manufacturers’ online sales leap in the last few years to in excess of 8%. If online sales do grow rapidly, manufacturers could easily be caught out and those left napping could see their shares decline whilst their sales in traditional outlets suffer. Equally they may be caught in a double bind, as traditional retailers use price discounting to catch up, causing margins to tumble at the same time.

The alternative is that online will grow incrementally. In the US, sales online seem to be growing at a rate of between 9% per annum, albeit from a base of 8% of total retail sales. If sales grow at this rate, manufacturers will have more time to accommodate changes in their trade structure and the impact of these changes, whilst significant, will be far less dramatic.

In either scenario online retail has the potential to be a significant proportion of sales within 5 years, so changes in marketing strategies, organization structure and business process will become necessary for all.

Shoppers are the agents of change

Whatever happens, the agent of this change is neither the manufacturer nor the retailer however. 2013’s seasonal sales in Europe and the US show that shoppers will reach a tipping point where confidence levels reach a point were reticence to shop online is overcome. For anyone considering what to do now, the message is clear: Understand your shoppers better.

To really get to grips with what to do about online retail channels you need to know how your key target segments are likely to behave in the future. Research programs should consider:

- Which shoppers are likely to remain offline in the future, their relative importance to your brands and what their expectations from retail stores are.

- Which shoppers are already online, how important they are to your brands and what is needed to drive value from them.

- Which shoppers are likely to move online, how they may deliver potential brand value and how you should approach them to gain maximum leverage.

Should you act this year?

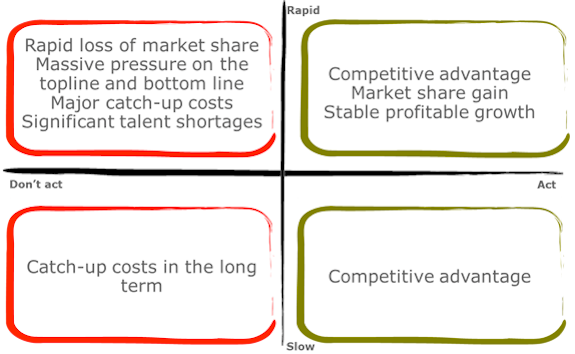

For those pondering whether it’s worth making such an investment in research consider this: There are only two likely outcomes: online retail will become important very rapidly or online retail will become important slowly. Against these outcomes you have two choices; to act now or not to. So in deciding what to do; draw matrix: on the vertical axis put rapid growth of online retail at the top and put slow growth on the bottom. On the horizontal axis plot action on the right and inaction on the left.

In the top right quadrant you now have a space where change is rapid but you’ve acted and can anticipate this change. As a result you are competitively ahead of your peers, market share grows and you assure long-term stable growth. Immediately below is the situation where you’ve invested, but online retail doesn’t take off rapidly. At first blush this might seem like you’ve wasted money but if you’ve worked hard on understanding all shoppers and not just those who might go online, you will gain competitive advantage from the insights you now have about shoppers in offline retail and you can anticipate the future. In both cases, you gain a positive result.

Contrast this with the outcomes of inaction – say change happens but more slowly; your inaction may not affect today’s results but as online becomes slowly more important, you may incur greater cost in the future to catch up. The worst outcome of all however is you don’t act this year and there is rapid change. In this scenario, the market moves rapidly ahead of you leading to market share loss and extreme pressure on the topline and bottom line. You have to respond relatively, which means you incur not just catch-up costs but also suffer from talent shortages.

Of course this is just my analysis but I would recommend as you ponder the future that you think about what might happen in your category and your market in the same way. If you feel that action is an imperative, feel free to contact me to discuss your next steps.